Mexico’s Corruption Crisis Deepens: 2024 CPI Reveals Historic Low & Global Implications

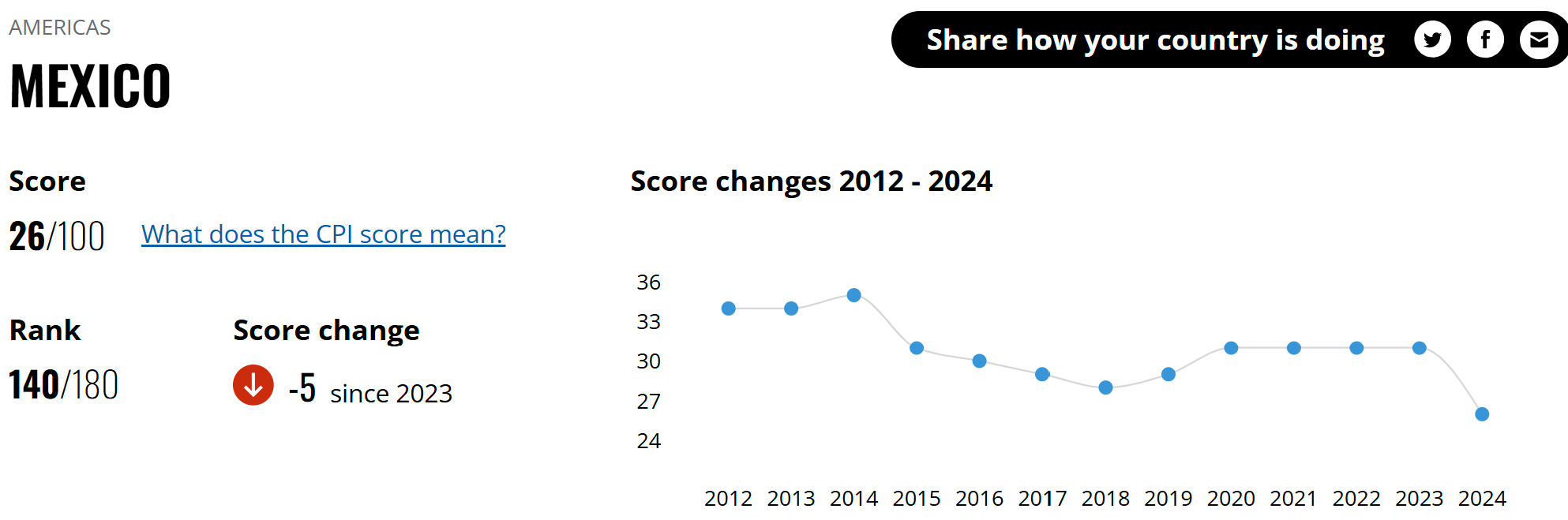

Mexico has hit a record low in Transparency International’s 2024 Corruption Perceptions Index (CPI), scoring 26/100 and plummeting to 140th out of 180 countries—its worst performance since the index began in 1995 . This marks a 5-point drop from its 2023 score (31/100) and positions Mexico as the lowest-ranked OECD member, trailing behind regional peers like Brazil (34) and Colombia (39)

Key Takeaways: Mexico’s Freefall in Global Rankings

- Global Rank: 140/180 (down 14 spots since 2023)

- Regional Context: Outperforms Guatemala (25) and Venezuela (10) but lags behind Brazil (34) and Chile (63)

- OECD Ranking: Dead last among 38 member states

- Global CPI Average: 43/100 (unchanged since 2023), with 68% of countries scoring below 50

Why Mexico’s Anti-Corruption Efforts Are Failing

The CPI highlights systemic failures driving Mexico’s decline:

- Organized Crime Ties: Cartels like CJNG and Sinaloa wield influence over public institutions, blurring governance and criminal networks.

- Judicial Uncertainty: Ambiguity around reforms to the National Anti-Corruption System and judiciary erodes public trust.

- Impunity: High-profile scandals, including Pemex’s Agronitrogenados, remain unresolved, signaling systemic unaccountability.

- Climate Corruption: Mexico’s low score aligns with global trends where corruption diverts climate funds—critical for a nation facing severe droughts and energy crises .

Global Ramifications: FCPA Enforcement Targets Cartels

The U.S. Department of Justice has prioritized prosecuting corruption linked to cartels designated as Foreign Terrorist Organizations (FTOs) under the Foreign Corrupt Practices Act (FCPA). Key risks for businesses include:

- Material Support Charges: Payments to FTO-linked entities (e.g., supply chain leaks) could trigger terrorism penalties.

- Reputational Damage: Companies entangled with cartels risk being labeled terrorism financiers.

Government Response vs. Reality

President of Mexico, Claudia Sheinbaum, dismissed the CPI’s credibility, citing doubled tax revenue as progress. However, critics argue this reflects enforcement gains, not reduced corruption. Meanwhile, the U.S. has paused non-cartel FCPA cases for 180 days, prioritizing national security-linked investigations .

5 Urgent Steps for Businesses in Mexico

- Enhanced Due Diligence: Audit third parties for cartel ties with a well designed due diligence process .

- Supply Chain Transparency: Map raw materials to avoid financing cartel-controlled regions (e.g., mining, agriculture), a formal and aligned audit process is key.

- Crisis Response Plans: Train employees to report extortion without yielding to cartel demands.

- Compliance Overhauls: Integrate FTO risks into anti-bribery policies and FCPA training.

- Collaborate with Authorities: Report suspicious activities to U.S. and Mexican regulators to mitigate liability.

How can ROE Latam help me?

At ROELATAM, we specialize in the design, implementation, and enhancement of Anti-Bribery Management Systems tailored to the regulatory and operational challenges of Latin America. Our services include:

Prevention of Organized Crime Risks: Implementation of robust mechanisms to identify and mitigate connections between clients, suppliers, or third parties and criminal organizations.

Supply Chain Transparency: Comprehensive supplier assessments, establishment of rigorous controls, and periodic audits to ensure operational integrity.

Anti-Bribery Crisis Plans: Development of immediate response protocols for corruption incidents, including regulatory notifications and reputational damage management.

FTO Risk Integration: Updating bribery risk matrices to incorporate threats linked to Foreign Terrorist Organizations (FTOs), with tailored controls and continuous verification processes.

Contact us at online@roelatam.com to strengthen your compliance protocols and ensure your organization operates with the highest standards of integrity and transparency.

Should you have found this article informative, we invite you to explore the following additional resources:

- Corruption Perceptions Index 2024 – Transparency International

- Corruption Perceptions Index 2024: Climate Crisis Link – Transparency International

- Transparency International Press Release (Global)

- Foreign Corrupt Practices Act (FCPA) Compliance

- ROE Latam Advises the National Public Security Academy of El Salvador on the Implementation of ISO 37001

- ROE Latam Advises CORSAIN of El Salvador on the Implementation of ISO 37001

- FCPA Enforcement Pause: 5 Critical Compliance Strategies to Mitigate Risk Now

- The 2025 FCPA Enforcement Pause: Implications for Anti-Corruption Efforts in Latin America

- ISO 37301: Compliance Management Systems